Credit notes

A credit note is a document issued by a seller to a buyer, indicating a reduction in the amount that the buyer owes to the seller.

Note

- Approved, partially paid, and paid invoices cannot be edited. Therefore, credit notes must be issued to amend such invoices.

- Draft invoices can be directly edited. Therefore, credit notes do not apply to draft invoices.

Refer to the documentation on the life cycle of a invoice for more details.

Some prominent reasons for issuing a credit note are listed below:

- Billing errors: if the buyer was overcharged (e.g., an incorrect amount was invoiced), a credit note corrects the error.

- Discounts: sometimes, sellers issue credit notes as a result of post-sale discounts or price adjustments.

- Returns: if the buyer returns goods or products, the seller issues a credit note to reduce the amount owed.

- Damaged goods: if goods received by the buyer are damaged or defective, the seller may issue a credit note to reflect the compensation or price reduction.

Create a credit note

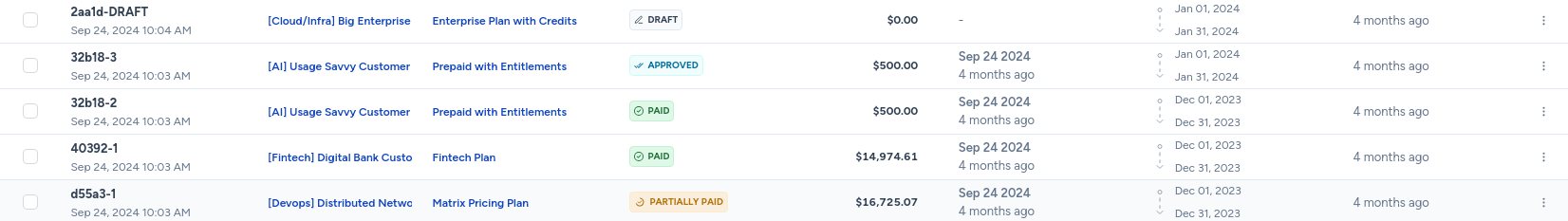

- Navigate to the Invoices page in the left side panel.

- Select the approved, partially paid, or paid invoice against which you wish to issue a credit note.

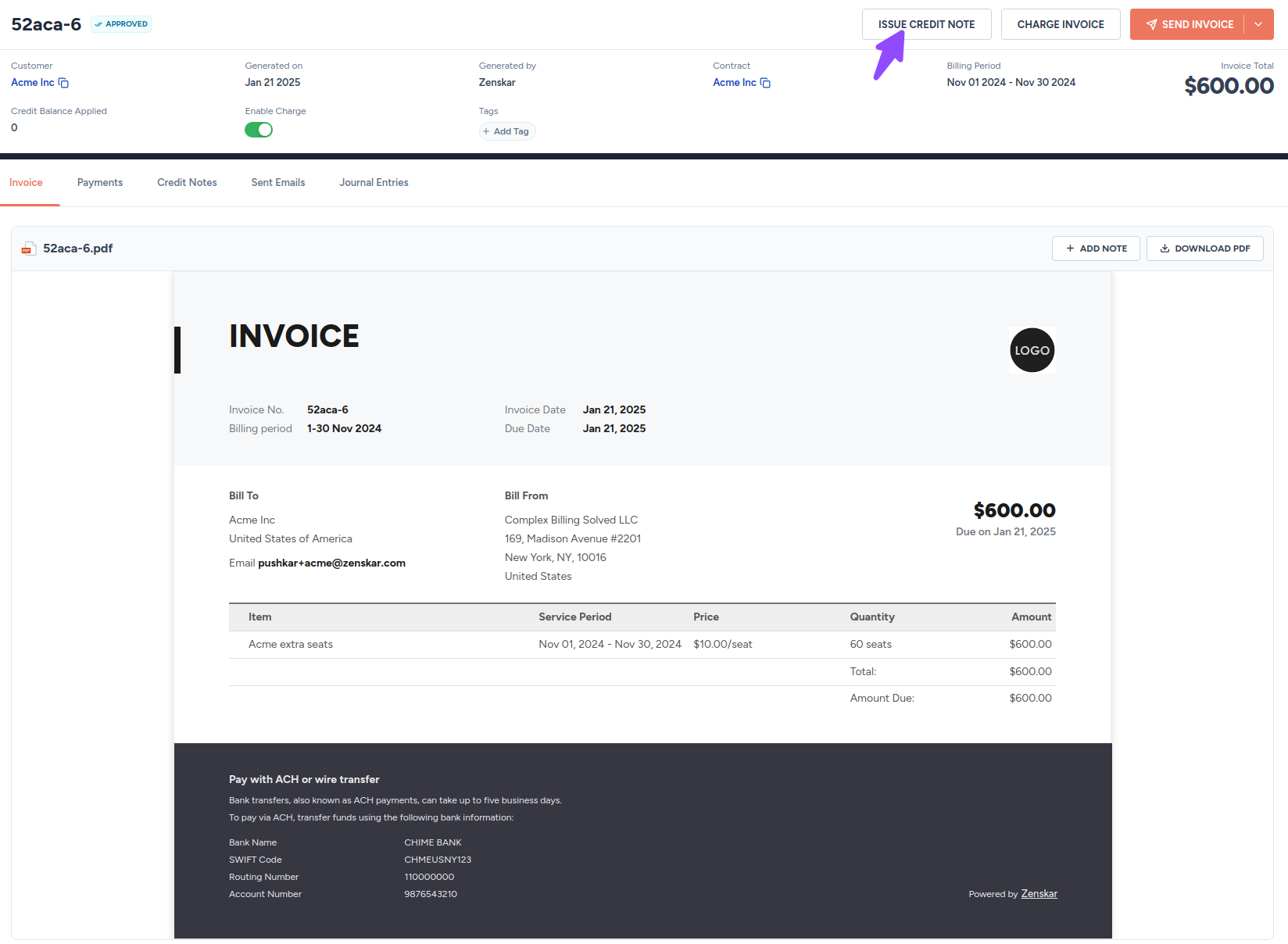

- On the View Invoice page, click on the ISSUE CREDIT NOTE button, as shown below:

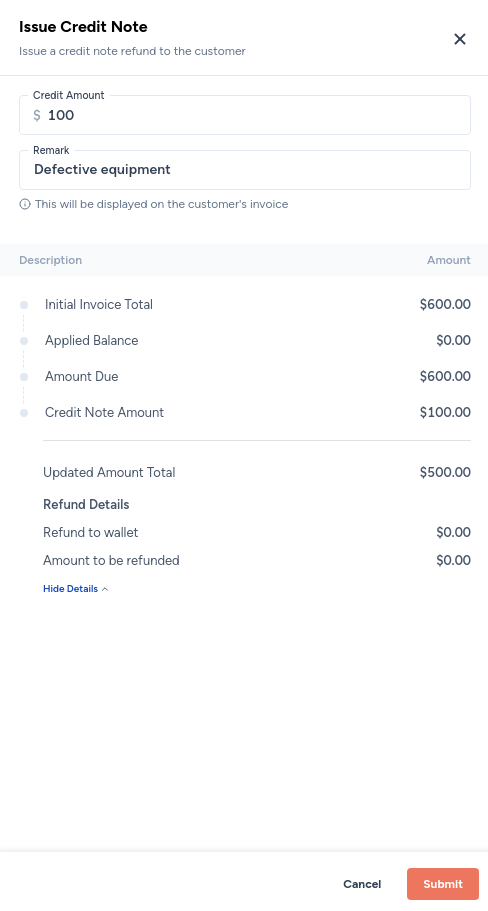

- Fill in the credit note details, and click on the Submit button on the Issue Credit Note form, as shown below:

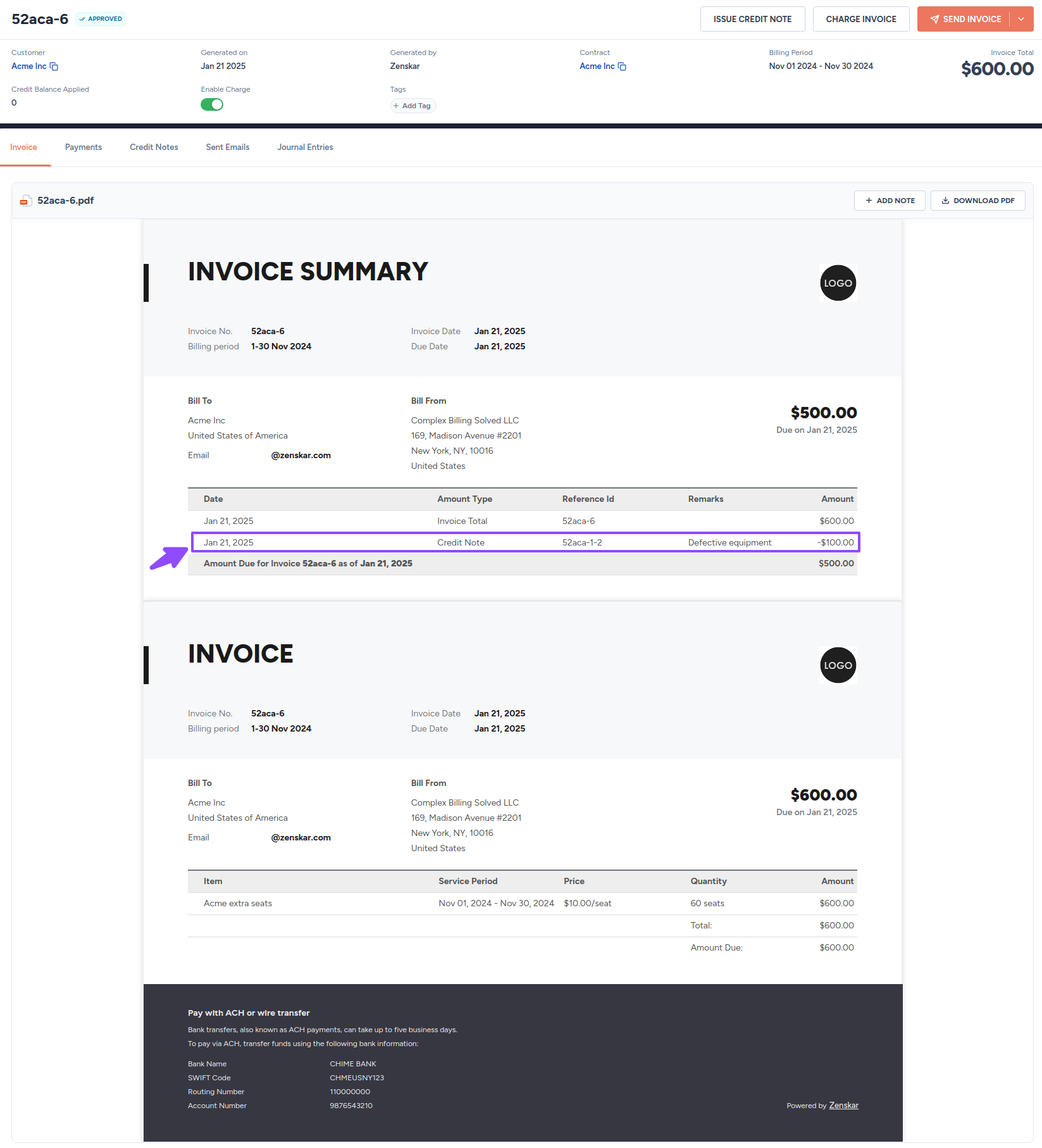

- A new invoice will be generated. The credit note will appear as a line item in the new invoice.

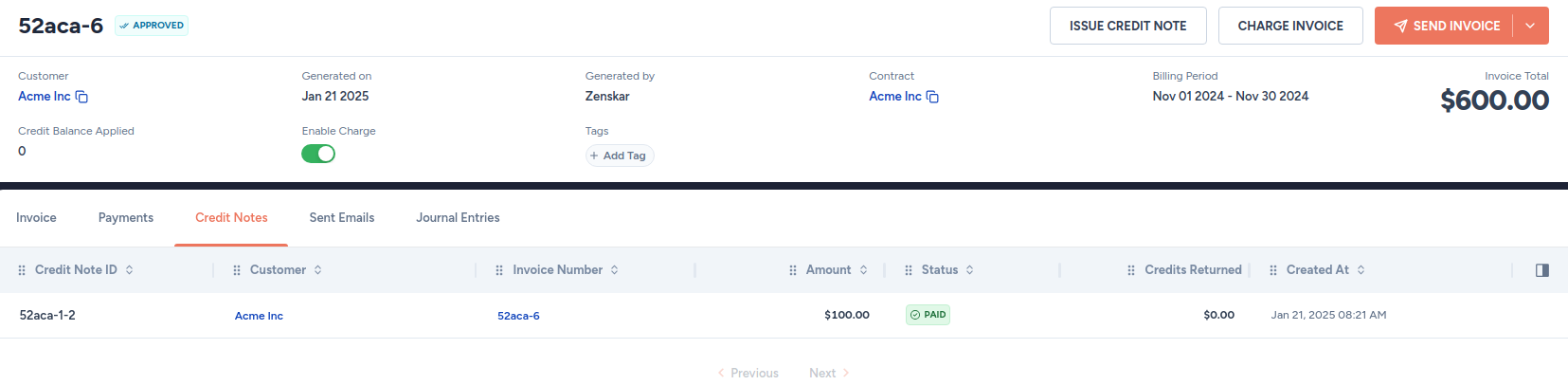

View credit notes

To view all credit notes issued against a specific invoice, navigate to the Credit Notes tab of the View Invoice page of the invoice you are interested in.

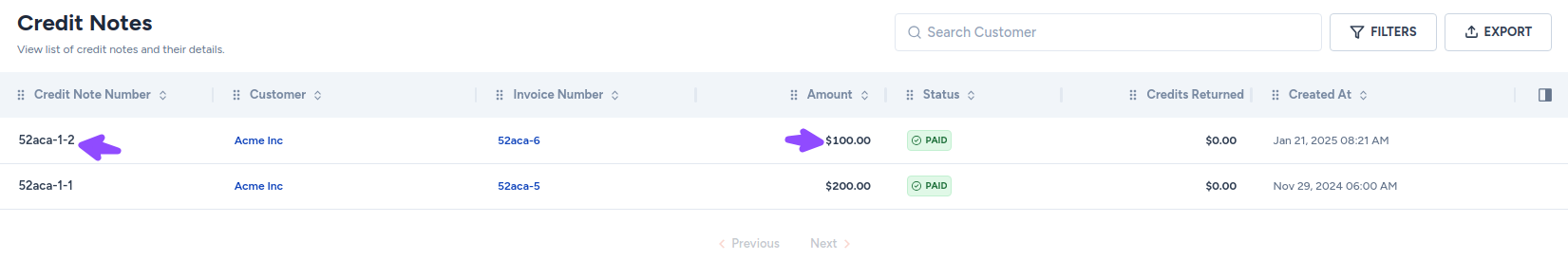

To view all credit notes Navigate to Invoices > Credit Notes in the left side panel.

Updated 1 day ago