QuickBooks

🐕🦺 Setup guide

This guide will help you connect your QuickBooks account with your Zenskar account.

- Log into your Zenskar account.

- Go to Integrations > ERP > QuickBooks and click on the Connect

button. - Complete the authentication using your company’s QuickBooks credentials.

- After completing the authentication, you will be redirected to the following page:

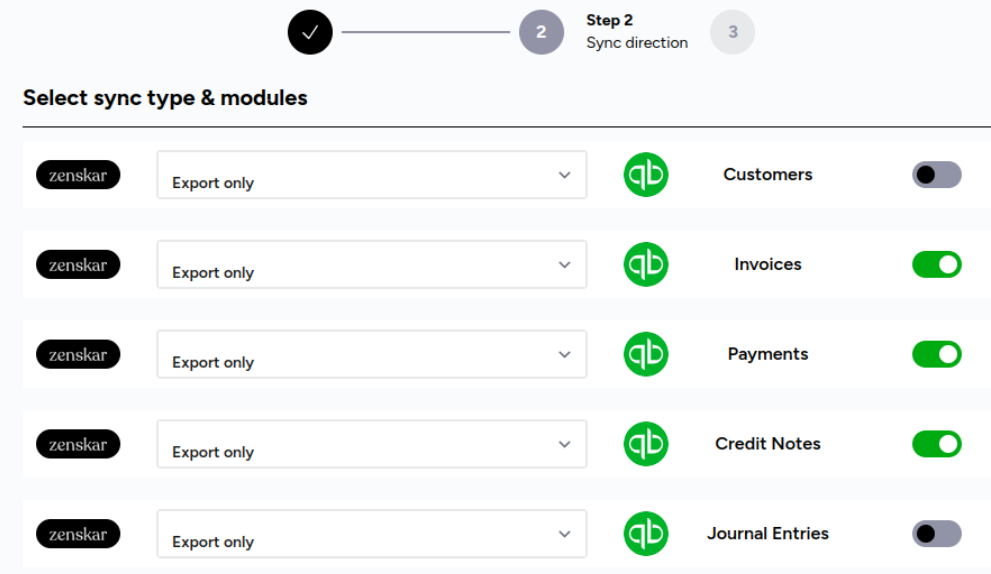

- Enable all the modules you want to sync with QuickBooks and click the Next button.

- The next page contains necessary configurations for all the modules you selected earlier. To configure the integration properly, you must understand the concept of a QuickBooks account:

The concept of an account in QuickBooksWhen you create a new company file in QuickBooks, you declare the type of business you have. Everyone gets the same set of standards accounts. QuickBooks adds additional accounts automatically based on your industry. If you do not see an account you need, you can create it manually.

The standard set of accounts:

| Account | What it’s for |

| Accounts Payable (A/P) | A record of the outstanding bills that your business owes. If your business uses multiple A/P accounts, QuickBooks will let you choose the account you want to use when you enter and pay bills. |

| Accounts Receivable (A/R) | A list of transactions related to customers who owe you money. If you need to use more than one A/R account, QuickBooks will let you choose the A/R account that you want to use when you create an invoice or receive a payment. |

| Opening Balance Equity | Ensures that you get a correct balance sheet for your company, even before you've entered all your company's assets and liabilities. |

| Payroll Expense | Tracks payroll items (expense) for the company, including salaries, wages, bonuses, commissions, company contributions such as company paid health plan and company paid portion of taxes such as Social Security and Medicare. |

| Payroll Liabilities | Tracks taxes you deduct from your employees' salary until you turn them over to the government, including federal and state income withholding taxes, local taxes and the employee paid taxes like Medicare and Social Security. |

| Retained Earnings | Tracks profits from earlier periods that have not yet been distributed to owners. At the beginning of the fiscal year, QuickBooks automatically transfers net income into your retained earnings account. |

| Sales Tax Payable | Tracks all sales tax you collect and pay. You might not see this account if you haven’t turned on sales tax in QuickBooks. |

| Uncategorized Expense | Money your business spends that needs to be categorized. |

| Uncategorized Income | Money your business earned that needs to be categorized. |

| Undeposited Funds (also called Payments to Deposit) | Holds cash or checks that your business is ready to deposit at the bank. |

| Inventory Asset | Tracks the current value of your inventory. You might not see this if you haven’t turned on inventory tracking. |

| Reconciliation Discrepancy | Tracks reconciliation adjustments. This account is automatically created if you have a discrepancy in a reconciliation. |

- Customers: No additional configuration is required for customer sync.

- Invoices: Select the account with which you want to associate your invoice line items. This account will be used while creating new items on QuickBooks.

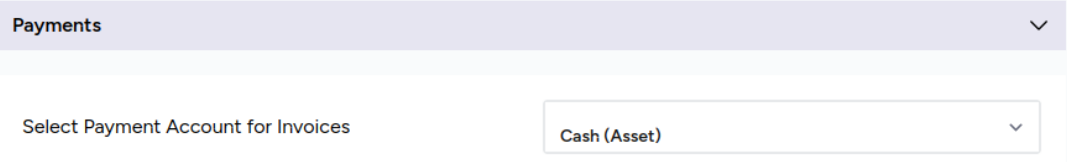

- Payments: Select the account to which you want your payments to be deposited.

- Credit Notes: Select an account to associate credit notes with. Currently, we allocate a single, consolidated credit note to an invoice. When exported, credit note on QuickBooks is named Credit Note (Zenskar). Work is in progress to support credit notes line items. Reach out to [email protected] if you would like to prioritize credit notes line items.

Important points

- QuickBooks does not allow allocation of credit notes to invoices that have no outstanding amount. Therefore, if you issue a credit note to a paid invoice, the credit note gets created on QuickBooks, but it is not allocated to any invoice.

- Ensure that a credit note is less than or equal to the total outstanding amount for the invoice. Else, the credit note will be created on QuickBooks, but it will not allocated to any invoice.

- The reason you enter while creating a credit note on Zenskar is used in the description field of the credit note object created on QuickBooks.

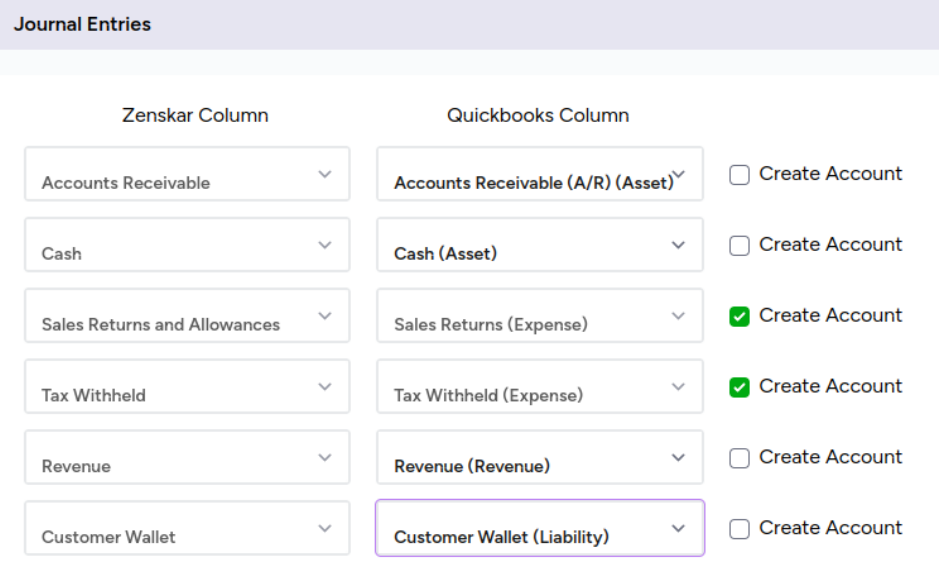

- Journal Entries: For configuring journal entries, you can map the accounts present on Zenskar to the corresponding QuickBooks accounts. If you want to associate a Zenskar account with a new account on QuickBooks, you can do that by:

- Enabling Create account

- Providing the desired name

- Selecting an account type.

- Revenue and Customer Wallet accounts are treated as parent accounts, and sub-accounts are created inside them on QuickBooks. For example, if you issue some credits to Customer A, then an account named Customer A is created inside the parent customer wallet account. This is used to record the relevant accounting entries.

Similarly, sub-accounts inside the parent Revenue account are created. For example, when an invoice containing Product A is approved, then a sub-account named Product A is created inside the Revenue account and relevant accounting entries are captured inside it.

Updated about 1 year ago